August 18, 2025 02:31 PM UTC

August 18, 2025 02:31 PM UTC

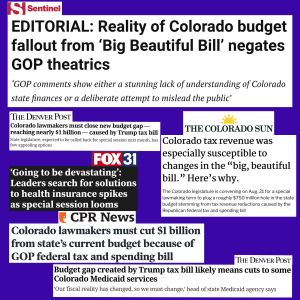

Brian Eason of The Colorado Sun has expanded on a story in last week’s “Unaffiliated” newsletter that we mentioned previously about the folly of cutting taxes as an effort to boost the economy and employment — particularly with Colorado’s unusual TABOR budgetary restrictions. This issue is popping up again ahead of Thursday’s special legislative session as Colorado Republicans attempt a narrative spin that media outlets across the state aren’t buying one bit.

Brian Eason of The Colorado Sun has expanded on a story in last week’s “Unaffiliated” newsletter that we mentioned previously about the folly of cutting taxes as an effort to boost the economy and employment — particularly with Colorado’s unusual TABOR budgetary restrictions. This issue is popping up again ahead of Thursday’s special legislative session as Colorado Republicans attempt a narrative spin that media outlets across the state aren’t buying one bit.

Before we dig in deeper on Eason’t story for the Sun, let’s examine an OpEd published in today’s Denver Post authored by Republican State Senator “Both Ways” Barb Kirkmeyer in which she again tries to make the argument that Colorado’s budget is not facing an $800 million hole because of President Trump’s big beautiful bullshit bill (OBBB):

When Gov. Jared Polis announced a special session to address a so-called “budget hole,” he and partisan Democrats were quick to point their fingers at Washington, D.C., blaming Republicans in Congress for our state’s fiscal troubles.

The real problem isn’t in Washington. The real issue is right here at home, under the Gold Dome.

Nope! We addressed this silly argument at length on Friday. Kirkmeyer is trying to say that Trump and a Republican Congress didn’t make any sort of budget cuts in passing the OBBB. Poll after poll has demonstrated that even average American voters know better than this. Hell, Republican leaders in Washington D.C. repeatedly said out loud that they were slashing funding for programs like Medicaid and SNAP (food stamp) benefits in order to pay for tax cuts for rich people.

Rather than taking responsibility for their choices, Polis and his allies want to raise taxes again, only this time they’re aiming squarely at the people who can least afford it. Their plan includes ways to exempt Colorado taxes from the recent federal tax breaks — increasing taxes on overtime and doing the same for taxes on small businesses and job creators.

Kirkmeyer knows damn well that the legislature can’t raise taxes without a vote of the people. This was the main selling point of TABOR when it passed in 1992. But regardless, it is not in dispute — unless you are trying hard to spin things in a factually-untrue direction — that Colorado now has an $800 million budget hole that it didn’t have before Trump signed the OBBB into law on July 4.

So what does Kirkmeyer think we should do instead?

But in spite of the governor’s lack of action and unwillingness to work with Republicans, my colleagues and I are introducing a bill to save $663 million, and not a single person’s tax bill will go up. By pausing the refund in the family affordability tax credit that sends hundreds of millions of dollars out the door each year, we can close the entire budget shortfall without raising taxes on anyone. It’s a simple, responsible step to keep our budget balanced and protect essential services.

What Kirkmeyer is essentially proposing is to raise taxes on lower income Coloradans in order to cover the cost of tax cuts for the wealthy that were extended in the OBBB. She gets caught up here by her own tortured logic. Just a few paragraphs earlier, Kirkmeyer argued that Democrats would be “raising” taxes if they tried to exempt tax breaks for overtime and other minor changes for lower-income Americans that were included in the OBBB…but Kirkmeyer then proposes doing the exact same thing with a different pot of money (blocking the family affordability tax credit for lower-income Coloradans).

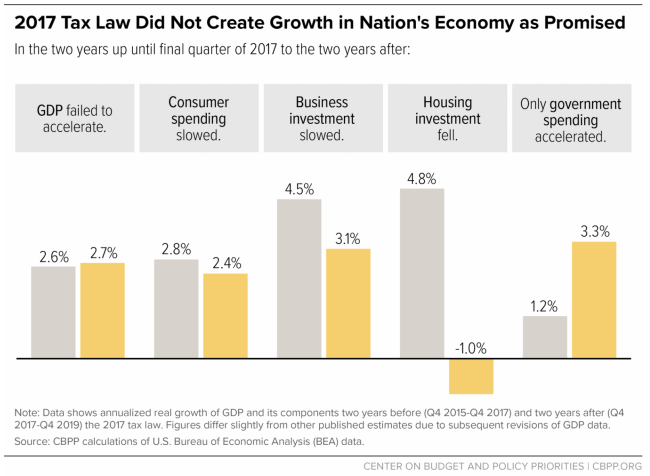

Colorado Republicans are going to say a lot of bullshit this week and next about how tax cuts benefit the economy and increase employment, yada, yada. There’s simply no evidence to support this idea; something as true now as it was when President Reagan was fawning over the idea of “trickle down economics” in the 1980s. President Trump and Congressional Republicans touted the economic benefits of cutting taxes for rich people as they rammed the OBBB into existence, but we already know that the original Trump tax cuts of 2017 didn’t do jack shit for the economy.

Colorado Republicans are going to say a lot of bullshit this week and next about how tax cuts benefit the economy and increase employment, yada, yada. There’s simply no evidence to support this idea; something as true now as it was when President Reagan was fawning over the idea of “trickle down economics” in the 1980s. President Trump and Congressional Republicans touted the economic benefits of cutting taxes for rich people as they rammed the OBBB into existence, but we already know that the original Trump tax cuts of 2017 didn’t do jack shit for the economy.

Cutting taxes in Colorado is an even dicier proposal than in any other state because of TABOR, as Eason explains for The Colorado Sun:

The TABOR cap limits state spending to the combined rate of population growth and inflation. When tax collections grow faster than the cap, the state has to refund the difference to taxpayers. So when the surplus is large enough, cutting taxes doesn’t affect what the state can spend on services. Taxpayers just pay less up front, and the state owes fewer refunds later.

Trouble is, that’s only true as long as the state collects enough tax dollars to stay above the cap.

“We do these short-sighted things, because some groups want to shrink government,” former state Rep. Chris DeGruy Kennedy, the president of the Bell Policy Center, told The Sun in an interview. The tax cuts weren’t that impactful while the state was over the TABOR cap, he said, “but now, we’re seeing the damage from this.”…

…It’s not the first time that statewide income tax cuts passed at a time of TABOR surpluses exacerbated a fiscal crunch shortly thereafter.

With large surpluses to work with in 1999 and 2000, Colorado lawmakers passed two rounds of income tax cuts, slashing the rate from 5% to 4.63%, which is where it stayed until 2020’s Proposition 116.

In the intervening years, TABOR surpluses were rare. Instead, Colorado faced repeated budget crises brought on by two recessions, leading to deep cuts to higher education and the eventual creation of a decade-long K-12 school funding shortfall, known as the budget stabilization factor.

If history repeats itself, we can’t say we weren’t warned.

In 1999, then-Gov. Bill Owens championed a bunch of tax cuts. Out of office six years later, Owens was campaigning around the state in support of Referendum C, which gave Colorado a five-year reprieve from the ratchet effects of TABOR. As we wrote in this space in November 2010:

The reason Referendum C passed in 2005 is the same reason why Republicans in Colorado failed to capitalize on the “Republican wave” in 2010. There was a recognition in 2005 among Colorado’s conservative-leaning but fiercely independent electorate that ideological rhetoric about “small government” had gone too far, and produced unintended consequences. Conservatives arguing against Referendum C could not explain why it’s okay for Colorado to rank near the very bottom of states for public funding of, just as one example, education. As much as people responded favorably to ideological catch phrases, their own eyes and common sense told them that there was a limit–that some government is necessary, and that the ideologues running the GOP just couldn’t be trusted to know how much cutting was too much.

You can argue over the definition of a “tax cut” versus a “tax increase” depending on how Republicans like Kirkmeyer try to spin things. What you cannot do is find decent examples of how tax cuts — particularly those aimed at the wealthiest among us — have ever given a meaningful boost to the economy. A few years back, researchers at the London School of Economics studied the impact of cutting taxes for the wealthy — which Colorado Republicans want to protect in the special session — across a 50 year time span. Here’s what they found:

Economic performance, as measured by real GDP per capita and the unemployment rate, is not significantly affected by major tax cuts for the rich. The estimated effects for these variables are statistically indistinguishable from zero.

There is a wealth (pun intended) of information contradicting the idea of “trickle down” economics [HERE, HERE, HERE, and HERE, for starters]. For a real-life example, you need look no further than Colorado’s neighbor to the east: In 2012 and 2013, Kansas Governor Sam Brownback promoted the “trickle down” impacts of slashing the top rate of the state’s income tax by almost 30 percent and reducing the tax rate on certain business profits to zero. The result? Economic growth and employment plummeted, as did state revenues. In 2017, Kansas lawmakers rescinded the cuts and Brownback — who had been promoted as a potential GOP Presidential contender — became a political pariah.

There is a wealth (pun intended) of information contradicting the idea of “trickle down” economics [HERE, HERE, HERE, and HERE, for starters]. For a real-life example, you need look no further than Colorado’s neighbor to the east: In 2012 and 2013, Kansas Governor Sam Brownback promoted the “trickle down” impacts of slashing the top rate of the state’s income tax by almost 30 percent and reducing the tax rate on certain business profits to zero. The result? Economic growth and employment plummeted, as did state revenues. In 2017, Kansas lawmakers rescinded the cuts and Brownback — who had been promoted as a potential GOP Presidential contender — became a political pariah.

There is a better option, as Eason points out for The Sun:

In 2024, the Democratic majority faced pressure from Gov. Polis and legislative Republicans to cut income taxes while the TABOR surplus was measured in the billions of dollars. But legislative Democrats insisted that the tax cuts be temporary, and only kick in when the state has a large enough TABOR surplus to afford it without cuts to services.

Last tax year, the income tax rate fell temporarily to 4.25%, shaving over $450 million off income tax bills. This year, it’s back up to 4.4% — and after the federal tax cuts, legislative forecasters don’t expect the provision to cut taxes again until the 2027 tax year.

President Trump and Congressional Republican zombies are the reason we are in this current financial mess in Colorado. Nobody who tries to make a serious argument otherwise has any real leg to stand upon.

What Colorado needs now is for lawmakers to avoid making the same mistakes from our past and to generally ignore dishonest politicians (like Kirkmeyer) who would rather try to score political points than fix problems. You can’t get out of a fiscal hole by digging deeper.

Subscribe to our monthly newsletter to stay in the loop with regular updates!

Comments