CO-04 (Special Election)

See Full Big Line

(R) Greg Lopez

(R) Trisha Calvarese

90%

10%

President (To Win Colorado)

See Full Big Line

(D) Joe Biden*

(R) Donald Trump

80%

20%↓

CO-01 (Denver)

See Full Big Line

(D) Diana DeGette*

90%

CO-02 (Boulder-ish)

See Full Big Line

(D) Joe Neguse*

90%

CO-03 (West & Southern CO)

See Full Big Line

(D) Adam Frisch

(R) Jeff Hurd

(R) Ron Hanks

40%

30%

20%

CO-04 (Northeast-ish Colorado)

See Full Big Line

(R) Lauren Boebert

(R) Deborah Flora

(R) J. Sonnenberg

30%↑

15%↑

10%↓

CO-05 (Colorado Springs)

See Full Big Line

(R) Dave Williams

(R) Jeff Crank

50%↓

50%↑

CO-06 (Aurora)

See Full Big Line

(D) Jason Crow*

90%

CO-07 (Jefferson County)

See Full Big Line

(D) Brittany Pettersen

85%↑

CO-08 (Northern Colo.)

See Full Big Line

(D) Yadira Caraveo

(R) Gabe Evans

(R) Janak Joshi

60%↑

35%↓

30%↑

State Senate Majority

See Full Big Line

DEMOCRATS

REPUBLICANS

80%

20%

State House Majority

See Full Big Line

DEMOCRATS

REPUBLICANS

95%

5%

August 08, 2011 09:58 PM UTC

August 08, 2011 09:58 PM UTC 62 Comments

62 Comments

Duh.

Tax cuts increase gov’t revenue. Always, every time.

Think how much more in debt we’d be if we didn’t have the tax cuts.

Unfortunately, that’s the only thing I can think of/care about. If the answer isn’t tax cuts, ipso facto, there isn’t an answer.

tax cuts on tax cuts.

We’ll cut our way out of this mess.

Cut Baby Cut

1-800 TAX CUTS !

TAX-CUTTERAMOS !

There’s a lot more tax cut where that came from

Tax cuts in the morning, tax cuts in the afternoon.

tax cuts, tax cuts, and more tax cuts. The real solution, the real way to govern. Gotta have em, all the time, every time

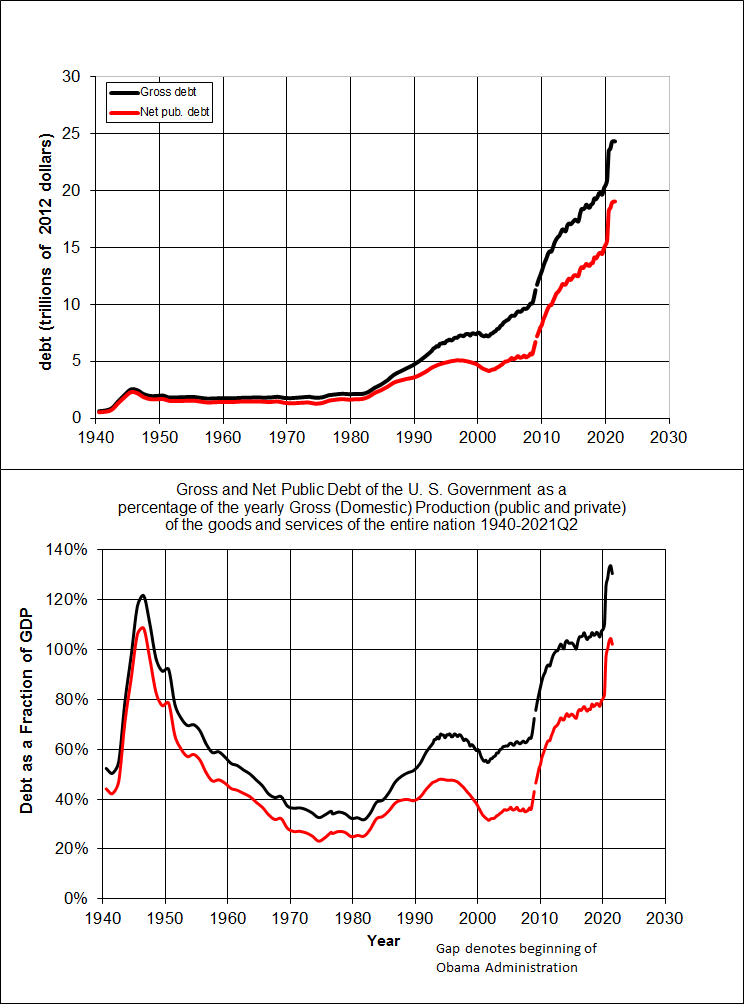

You are showing deficits instead of debt. The difference is that we have been ACCUMULATING debt for the last century, and it is way higher than it was back then. What you are showing is the INCREASE in debt, not the debt itself.

Still, the war on terror hardly compares to WWII. And wasn’t Obama supposed to end those wars anyway? Yet he got us into another one.

It ain’t defense spending that’s busting this budget. Perhaps if the so-called “stimulus” had actually done anything, the increase in debt would be justified.

doesn’t take into account the wars in iraq and afghanistan.

we need more tax cuts

You probably still love the smell of the burning flesh of bodies smoldering in a wreckage. You are one patriotic son-of-a-bitch aren’t you, you fucking Republican warmonger. Do you really want any war to end?

But that’s kinda over the line, brah. Simmer down a notch? I like you over here, not making finger paintings on the penalty box walls 🙁

But that probably won’t prevent you from promoting his next diary.

Stupid is as stupid does.

is watching someone else do it. Honestly I don’t even know what this is based on. I remember PC having a seemingly minor dispute with MOTR (that seemed based more on a misunderstanding than anything else) and all of a sudden this. It’s one thing if you two actually had a policy disagreement, but I’ve never actually seen one. I’m honestly curious to know what PC did to get you following her around and insulting her.

I’m sure there WAS something, but I have to give Ralphie a lot of credit for his memory holding that grudge, because I’ve completely forgotten what in the world happened. Maybe I defended Nancy or something? And MOTR and I get on fine unless she feels differently, can’t even recall any specific disputes with her, truth be told.

Good to know you’re an equal opportunity attack dog though.

Actually I was going to warn PC the other day – it’s dangerous being nice to someone like me around these here parts. Definitely hurts your lefty street cred. You’re probably a pretty young progressive and you haven’t completed the indocrination yet (although I hear Nancy is trying to whip you into shape). You probably still believe in progressive values, hope, change, unicorns, etc. Your mentors haven’t let you in on the big secret yet – there are no values. You’re supposed to do and say whatever your progressive overlords tell you to do. It’s only about extractring revenge on the evil empire and siphoning off tax dollars from them. Being friends with one of them is detrimental to your progress in lefty circles.

That’s another one for the repentance file, isn’t it?

Where you talking about Denver’s election? Because you posted a diary on February 26, 2011…

I haven’t posted a diary here since February. I forgot about a few of them.

If I haven’t posted here in six months, certainly since before PC was elected, why would anyone think PC was going to promote one of my (non-existent) diaries?

I was just having fun with yet another beej error.

But believe me hon, I may be a young progressive but I am not new to the Internet. I don’t think it’s cool to get beyond the pale nasty to anyone, and I don’t really care if that makes people mad.

I am, according to Penry, one of the “surrender monkeys” over here in the GOP.

Gopher Girl? Glum Girl? Good Girl? Graphic Girl?

And I knew there must be some reason I was starting to feel friendly to ya 😛 I guess that’s it, if Penry’s mad at ya I can’t hate you too hard.

as long as he doesn’t have to serve.

If there was a picture of “chickenhawk” in the dictionary, it would be a picture of B.J. Wilson.

why are you still sitting here in Colorado then?

First some factual data

2010 Defense spending $685.1 billion

2010 Federal Budget: $3.55 trillion

so defense spending is very close to 5% of GDP,

But what you are really getting at is the idea that the composition of our spending is different. Good point- I agree.

So, to humor you and stay focused on spending for now , we could identify the major differences in spending.

Your knee jerk reaction to spending “it’s too much” is easy enough to understand. But you do see that when discussing the debt, spending is only 1/2 of the equation, yes?

Revenues as a percent of GDP

So we are a low tax country, and have a decining tax burden as a percentage of GDP.

But to get back to your composition point –

1 United States 698,105,000,000

2 China 114,000,000,000

3 France 61,285,000,000

4 United Kingdom 57,424,000,000

5 Russia 52,586,000,000

6 Japan 51,420,000,000

7 Germany 46,848,000,000

8 Italy 38,303,000,000

9 Saudi Arabia 39,200,000,000

10 India 36,030,000,000

11 Brazil 27,120,000,000

12 Australia 26,900,000,000

13 South Korea 26,550,000,000

14 Spain 25,507,470,000

15 Turkey 25,000,000,000

15 Canada 21,800,000,000

16 Iraq 17,900,000,000

17 Israel 16,000,000,000

18 UAE 15,749,000,000

19 China (Taiwan) 15,000,000,000

20 Netherlands 11,604,000,000

USA spends the same as the next 20 countries combined.

Maybe we do live in a really dangerous world. Biut the composition argument that says defense doesn’t matter seems …questionable.

I’m all for a strong enough national defense. But, I’m not willing to have an ideological argument about which wars and military actions were “more or less” worth pursuing with someone who neither understands the historical context, nor values the service. From a budget assessment point of view, the spending matters. (Not to try and get your head to explode, but you should research what the founders had to say about a standing military. ONce you do, can I assume you’ll be volunteering?)

Social Security is self funded.

So the deficits come from too little revenue, Medicare (including the unfunded Part D prescription benefit).

How do you propose we limit Medicare spending?

And increase revenue?

Well composed post and comments.

But yesterday on Meet the Press, Alex Castellano, a Romney consultant, said the way to stimulate the economy and reduce the deficit is (you guessed it) by cutting taxes. Republicans want to control the defeicit by cutting revenue even more and thereby creating an even larger deficit and national debt.

History has proven them dead wrong twice. Neither President Reagan’s 1981 tax cut legislation or President Bush’s 2002 tax cuts ever stimulated the economy enough to make-up the renevue lost. In fact, in the end President Reagan agreed to “revenue enhancements” (tax increases) because the annual deficit was out of control in part due to the tax cuts and to President Reagan’s 10% increase in defense spending. In short, he decreased revenues, increased spending and then crossed his fingers (supply side economics) in the hope the tax cuts would increase economic activity to the point new tax revenues would make up for both the loss of revenues and the increased spending. It never happened.

With history staring him the face, Presidnet George W. Bush made the same assumptions Presidnet Reagan did with the same results – decreased revenues and runaway deficits.

Today, people like Mr. Castellano and House Budget Committee Chariman Paul Ryan are fully prepared to make the same mistake for the third time in thirty years. There is only one conclusion one can draw from their statements and actions. Republicans couldn’t care less about the deficit or debt reduction. Their primary reason for all of this at this point in time is to use this as a cover to destroy the federal government. Deficit reduction and debt control are the last thing on their mind.

yep

It happens.

Can I get a t-shirt or a hat that says that?

He’s proposing something so unique and untested in American democracy – tax cuts !

Why the hell didn’t anyone else think of it ?

We should really try it just to see if it works ! It could be our best way out of this mess !

The demon left sexpee and possessed FDN!

everything for them boils down to tax cuts, so they can carry the water for the rich, either knowingly (ArapaGOP) or unknowingly (Tea Party).

It all comes back to what the rich want, whether or not it makes any economic or budgetary sense at all.

beej is online. Will he have an answer for this? Odds are 5-1 that he won’t, and 100-1 that any answer he gives will actually address these data.

You really ought to stop putting your foot in your mouth so much. You’re in my fan club and you’re not reflecting well upon me.

Look at the comments on the front page… you made about three other irrelevant posts after I made my observation. Not to mention that you fulfilled my prediction that you would ignore MADCO’s points.

the page that came up the moment after I submitted my comment had your comment. I then moved on to make other posts on other threads. I fully addressed MADCO’s points, and scored a debate win in the process.

This isn’t church, so no one is going to take what you say on faith. Blithely dismissing MADCO’s observation that revenues are half the discussion, as well as not giving any ideas for how to raise them, do not address what he said or answer the questions he asked you.

I reject the premise.

Dinosaurs and humans did not co exist.

Budget deficits are the result of spending and revenue.

You rejecting anything demonstrably is useless.

Do it enough and you are useless.

Do you want to be useless?

Of course this was the plan all along; blow spending through the roof and then blame the taxpayers for not shelling out more money. Obama’s spending was wasteful and unjustified in the first place. The remedy is not to support the problem by forking over more of our money; the revenue is to stop pissing money down the drain.

As far as taxes, we have the highest corporate tax rate in the world, which drives companies and jobs overseas. I know, I know, and I agree, close the loopholes. If we want to be like the rest of the world, then we can raise taxes on the 50% of us who don’t pay any. But given that Obama is pushing for a payroll tax cut, I don’t think anyone is in favor of raising taxes on the middle class right now.

The deficits come from too much spending, period. We don’t even have to touch social security, medicare, or medicaid, to make big changes right now. Freeze spending, remove the stimulus from the baseline (it was supposed to be temporary, remember?), and repeal Obamacare. That right there would go a long way toward balancing the budget.

And one other thing, before you start the caterwauling about cuts and trotting out victims, you should realize that we’re all paying for this one way or another. Higher gas and food prices due to inflation disproportionately affect the poor.

“remedy”, not “revenue”

But while the US has the 2nd-highest corporate tax rate (35%), US corporations don’t pay anywhere near the highest tax rate among the world’s leading economic countries – our tax code has more holes than a sieve.

If you figure out actual corporate income tax payments, the US is only average or below average. If you measure them as a percentage of GDP, we’re actually 2nd lowest. And that doesn’t count VAT, which companies overseas have to pay and we don’t.

Regardless of bond rating, the market was going to correct. You can’t base society on debt,welfare,redistribution,smoke and mirrors,Goldman Sachs,bombs,destruction,inflation,funny money etc…

Somewhere in the equation production must be included.

I don’t care about “the markets” at present. May never again.

Dow 10,000!! yawn

Interest rates – I care.

i > inflation > cost of living and standard of living. I care.

why wouldn’t you assume S&P is correct?

As noted, the last time we had this kind of debt structure was right around the end of WWII. As also noted our reaction to that debt, as reflected by the tax structure at that time, was markedly different — so as to pay that debt. This ain’t 1945, and our rating probably ought to reflect that our approach to the issue is markedly different (i.e., preposterous), don’t you think?

One additional point — our corporations GM, Ford, Microsoft, Verizon, etc., etc. will not see a per se change in their rating because the U.S. rating has been downgraded — apples and hand grenades. These entities still have the same (much better) balance sheets and cash flows than Uncle Sam. Their rating will not be impacted. What will be impacted is their future cost of borrowing because with the US now in the market borrowing (demanding funds with their lower rating at higher rates), it will force (allow?) the market to charge higher rates to everyone else — not just the corporations, but you and me and your realtives and your neighbors and even the Beej (and probably MarkG — once he finally turns 18). That will be the direct result of this downgrading — higher interest costs for everything. All other things being equal, the ratings of the individual and corporate borrowers will remain unaffected.

(This, of course assumes, that their employment and income situations remain unaffected — which it will not. But, the point remains, it is not simply the downgrading of the US debt that will have a direct impact on the ratings of its citizens and corporations.)

T-bills are auctioned and traded. There’s no set price. If the S&P downgrade meant anything, then people should be fleeing T-bills for cash or something else. That would drive the bond price down and the yield up. However, yields have been falling. Thus (so far), the market doesn’t seem to care what S&P says.

Austerity measures in the U.S. and Europe mean that governments aren’t going to prop up an economy sliding into recession. Investors see that and flee to safe havens. Stocks tank.

What am I missing?

when you’re going down in the North Atlantic, a leaking lifeboat is generally preferred to being shipboard, but I’m just guessing . . . these are also very muddied waters right now (mixed metaphors intended).

S&P is not a legitimate ratings agency. They have been bought out by the super-rich, super-conservative and Republican Party.

Look at their bond ratings from the 2000s. Completely missed the boat on mortgage bonds, banks, Lehman Brothers, probably because they’re paid by those same bond holders, banks and investment companies. It would have been politically incorrect to be truthful to downgrade the ratings of those-who-write-their-paychecks.

This is more obvious in the present ratings downgrade. They made a bone-headed (junior analyst) $2 Trillion mistake. admitted it, and then went ahead with the downgrade, specifically because they want the government to cut entitlements.

IT ISN’T ABOUT THE DEFICIT!

(Raise taxes… poof! no more deficit!)

The deficit discussion is nothing more, nothing less than a political assault by the Republicans and super-Rich on the middle class.

Madco,

Today’s debt and deficit are different than yesteryears debt and deficit. Today’s debt will end up in the trash can ( i.e. T.V, R.V. DVD, etc.). Yesteryears debt was for capital investment.

Would you want to own your neighbors debt?

and tanks and battleships and munitions are not really considered productive capital investments . . . sorry, didn’t mean to get facty . . . blither on . . .

Fine. We agree. Breaking stuff, whether it be by the military, DEA or mother nature is never a productive endeavor. See Broken Window Theory for more explanation.

Maybe the bond rating companys are getting smarter or should I say, less in bed with gov?

A further dowgrade is in order till we rectify our spending addiction.

Agree.

If you want to have a substantive discussion about that composition – I’m in.

If you want to throw out irrelevant one-liners and straw men, I’m out. That means no cadillac driving welfare queens living public housing. INstead explain how the ag industry determines what food stamps can buy, and how the ag industry uses the food stamp program as a giant subsidy.

Depending on your district, explain why your Congressman supports ag subisdies, the personal mortgage interest deduction, other personal deductions, and two unfunded* wars.

* noworse than unfunded -we cut taxes as we were going to war.

(Just put the damn peanut butter sandwich down and blog already . . . )