U.S. Senate

See Full Big Line

(D) J. Hickenlooper*

(D) Julie Gonzales

(R) Janak Joshi

80%

40%

20%

Governor

See Full Big Line

(D) Michael Bennet

(D) Phil Weiser

55%

50%↑

Att. General

See Full Big Line

(D) Jena Griswold

(D) M. Dougherty

(D) Hetal Doshi

50%

40%↓

30%

Sec. of State

See Full Big Line

(D) J. Danielson

(D) A. Gonzalez

50%↑

20%↓

State Treasurer

See Full Big Line

(D) Jeff Bridges

(D) Brianna Titone

(R) Kevin Grantham

50%↑

40%↓

30%

CO-01 (Denver)

See Full Big Line

(D) Diana DeGette*

(D) Wanda James

(D) Milat Kiros

80%

20%

10%↓

CO-02 (Boulder-ish)

See Full Big Line

(D) Joe Neguse*

(R) Somebody

90%

2%

CO-03 (West & Southern CO)

See Full Big Line

(R) Jeff Hurd*

(D) Alex Kelloff

(R) H. Scheppelman

60%↓

40%↓

30%↑

CO-04 (Northeast-ish Colorado)

See Full Big Line

(R) Lauren Boebert*

(D) E. Laubacher

(D) Trisha Calvarese

90%

30%↑

20%

CO-05 (Colorado Springs)

See Full Big Line

(R) Jeff Crank*

(D) Jessica Killin

55%↓

45%↑

CO-06 (Aurora)

See Full Big Line

(D) Jason Crow*

(R) Somebody

90%

2%

CO-07 (Jefferson County)

See Full Big Line

(D) B. Pettersen*

(R) Somebody

90%

2%

CO-08 (Northern Colo.)

See Full Big Line

(R) Gabe Evans*

(D) Shannon Bird

(D) Manny Rutinel

45%↓

30%

30%

State Senate Majority

See Full Big Line

DEMOCRATS

REPUBLICANS

80%

20%

State House Majority

See Full Big Line

DEMOCRATS

REPUBLICANS

95%

5%

[wpdreams_ajaxsearchlite]

May 30, 2019 10:51 AM UTC

May 30, 2019 10:51 AM UTC

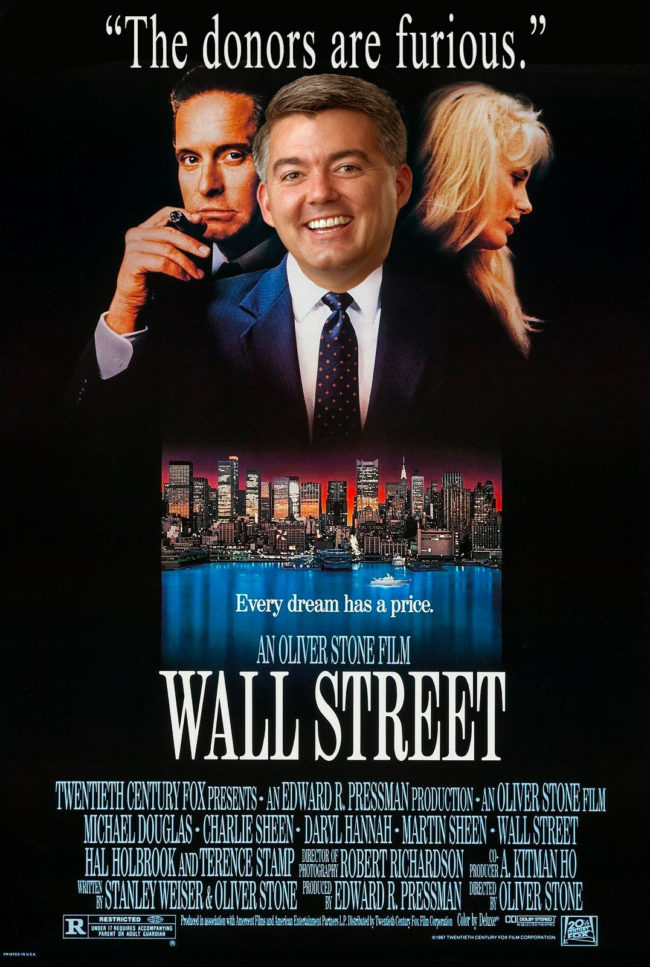

If Senator Cory Gardner wants to win his tough re-election fight next year, there’s really no constituency he can ignore–which helps explain why he’s all over the map on so many issues. But over a decade in Congress, and especially since entering the Senate, Gardner has allied himself closely with the one sector of society that

If Senator Cory Gardner wants to win his tough re-election fight next year, there’s really no constituency he can ignore–which helps explain why he’s all over the map on so many issues. But over a decade in Congress, and especially since entering the Senate, Gardner has allied himself closely with the one sector of society that

Comments