November 07, 2017 10:31 AM UTC

November 07, 2017 10:31 AM UTC

Yet another flashpoint in the debate over tax “reform” legislation passed by the U.S. House last week, which cuts tax rates and spikes the budget deficit by $1.5 trillion or more along with the eliminating a number of targeted tax credits, is a provision that apparently tries once against to establish legal rights for fetuses–another so-called “personhood” provision that could, supporters hope against hope, pry open a path to banning abortion. Rewire:

Page 93 of the 429-page plan, which a Washington Post analysis describes as rewarding big corporations and the “super-rich” at the expense of some small businesses, the working poor, and charities, outlines the GOP’s plan to designate “unborn children” as beneficiaries in 529 college savings plans.

The change appears to be politically motivated. Expectant parents already can put a 529 plan in their own name and switch the beneficiary when their child is born. That’s because 529 plans require the beneficiary’s social security number, which fetuses don’t have… [Pols emphasis]

The Republican plan provides fetuses with the federal benefits by saying that “nothing shall prevent an unborn child from being treated as a designated beneficiary or an individual.” The section of their tax plan goes on to define “unborn child” as a “child in utero”—”a member of the species homo sapiens, at any stage of development, who is carried in the womb.’’

The phrase “at any stage of development” dovetails with the GOP’s escalating anti-choice agenda under President Donald Trump and Vice President Mike Pence. Republicans on Capitol Hill are behind deeply unpopular “personhood” bills that try to classify fertilized eggs, zygotes, embryos, and fetuses as “persons,” and to grant them full legal protection under the U.S. Constitution, including the right to life from the moment of conception. The personhood laws would criminalize abortion with no exception and ban many forms of contraception, in vitro fertilization, and health care for pregnant people.

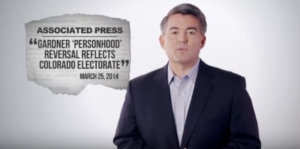

This seemingly innocuous language in a provision of the Republican tax bill pertaining to college savings accounts is of course not there by accident, and represents another attempt to give the “preborn” legal rights. Which could, so the legal theory goes, serve as a precedent for more rights, and eventually rights to–here comes the payoff–not be subjected to an abortion. That’s the whole essence of the “Personhood” debate, whether it’s in the ballot measures Coloradans have rejected over and over by lopsided margins, or the “Personhood” legislation in Congress that Sen. Cory Gardner falsely insisted was merely a “statement of principles”–distinct from the equivalently-worded ballot measures he disavowed when he ran for the U.S. Senate. All of these initiatives and bills are precursors to the ultimate goal of banning abortion.

Rep. Diana DeGette of Denver summed it up in her statement blasting the provision:

Congresswoman Diana DeGette (D-CO) said the provision in the just-released GOP tax plan allowing the start of a 529 college savings plan for an “unborn child” is an extreme policy that has no place in the tax code.

“This is a back-door attempt to establish personhood from the moment of conception,” DeGette said. “Even in the tax reform debate, Republicans could not resist including offensive provisions to appease an extremist minority. The tax code is no place to define what constitutes an ‘unborn child.’ What’s next, giving a Social Security number to a zygote?” [Pols emphasis]

She’s kidding, of course. But we’d say maybe don’t give them any ideas.

Subscribe to our monthly newsletter to stay in the loop with regular updates!

Comments