May 08, 2023 12:48 PM UTC

May 08, 2023 12:48 PM UTC

As the Colorado General Assembly grinds out the final hours of the 2023 legislative session, Democrats have restored at the last minute one of their most clever political tax policy moves from last year: making tax refunds due under the controversial 1992 Taxpayer’s Bill of Rights equal across the board for all earners, which has the effect of substantially increasing the amount refunded to lower-income households. This year, the proposal is linked to voter passage this fall of a larger property tax reform measure meant to balance funding obligations for education with relief after historic increases in real estate values.

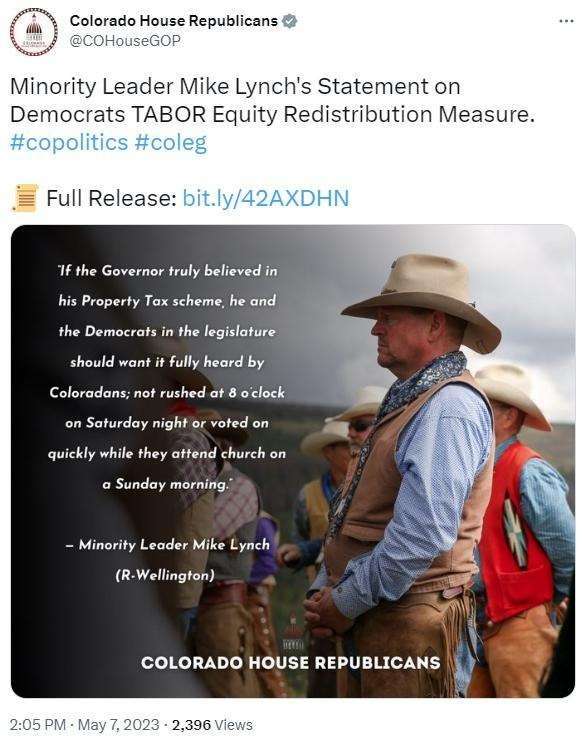

GOP House Micro-Minority Leader Mike Lynch, once more after 120 disappointing days of powerlessness even over his own caucus, expresses his displeasure:

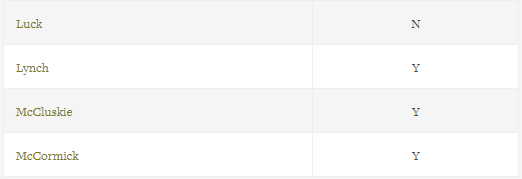

Note how Lynch’s objection isn’t limited to the timing or process, specifically denouncing the bill as a “redistribution measure” in reference to providing equal refunds to all households. The problem is that this is the second year Democrats have proposed identical refunds, and Lynch voted “yes” on last year’s Senate Bill 22-233, which made the same one-year change to the refund mechanism.

What changed between then and now? Today, Lynch is the Minority Leader of an even more fractious and radicalized House caucus than the late Hugh McKean presided over last year. Despite the fact the property tax ballot measure this refund depends on does exactly what TABOR demands and asks taxpayers for their approval, this bill to put more money in working people’s pockets passed the House without any help from Republicans. “Republicans opposed bigger TABOR refunds” will be the message for voters, and that’s the last thing they need with an already discontented base.

TABOR isn’t really about the voting, and Republicans this year were even less interested in cooperation.

Subscribe to our monthly newsletter to stay in the loop with regular updates!

Comments