CO-04 (Special Election)

See Full Big Line

(R) Greg Lopez

(R) Trisha Calvarese

90%

10%

President (To Win Colorado)

See Full Big Line

(D) Joe Biden*

(R) Donald Trump

80%

20%↓

CO-01 (Denver)

See Full Big Line

(D) Diana DeGette*

90%

CO-02 (Boulder-ish)

See Full Big Line

(D) Joe Neguse*

90%

CO-03 (West & Southern CO)

See Full Big Line

(D) Adam Frisch

(R) Jeff Hurd

(R) Ron Hanks

40%

30%

20%

CO-04 (Northeast-ish Colorado)

See Full Big Line

(R) Lauren Boebert

(R) Deborah Flora

(R) J. Sonnenberg

30%↑

15%↑

10%↓

CO-05 (Colorado Springs)

See Full Big Line

(R) Dave Williams

(R) Jeff Crank

50%↓

50%↑

CO-06 (Aurora)

See Full Big Line

(D) Jason Crow*

90%

CO-07 (Jefferson County)

See Full Big Line

(D) Brittany Pettersen

85%↑

CO-08 (Northern Colo.)

See Full Big Line

(D) Yadira Caraveo

(R) Gabe Evans

(R) Janak Joshi

60%↑

35%↓

30%↑

State Senate Majority

See Full Big Line

DEMOCRATS

REPUBLICANS

80%

20%

State House Majority

See Full Big Line

DEMOCRATS

REPUBLICANS

95%

5%

October 05, 2017 03:35 PM UTC

October 05, 2017 03:35 PM UTC 4 Comments

4 Comments

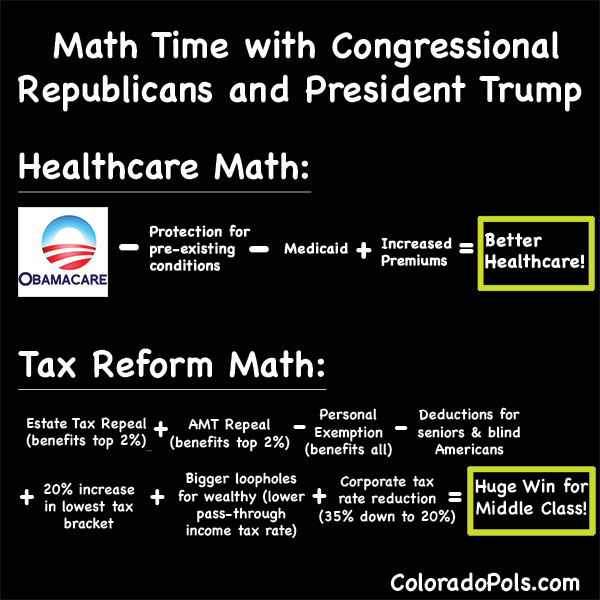

Ken plus the three Dems. I'm guessing this is not some sort of attempt at bipartisanship. (So Zappy, you can relax.) It's the schism between the deficit hawks and the borrow-and-spend practitioners to voodoo economics.

Reuters says: "The main problem is that the federal government is swimming in red ink with an annual deficit of $550 billion and a national debt — the accumulation of past deficits and interest due to lenders to the U.S. Treasury — exceeding $20 trillion."

We already know the Republicans want to expand military spending by almost $100 billion over the final Obama budget. Obama recommended an increase; Trump bumped that by an additional 3%; Congress added an additional 5%.

Thus far, there have been no indications of short term revenue gains from the Trump "plan." Outside groups estimate a loss of $2.4 Trillion over a decade… $240 billion a year.

So, the 3 Republicans in the majority apparently think

-($550 billion) -($100 billion) -($240 billion) will somehow be a sustainable government taxation and spending pattern.

In the real world, that's -($890 billion) — and the Fed is already saying it would be a short term burst, followed by substantial inflation.

So much for Republicans being the party of fiscal sanity.

Yesterday, Cory Gardner was interviewed on NPR and saying how great the Tax Reform is as a blueprint. He emphasized that the idea is for citizens to hold onto their own money and not to "send it to Washington where THEY waste it."

Sorry…Cory you are the THEY. So, you're saying that you and your Republican party (who hold ALL the levers in Washington) are wasting OUR money????

Yikes…Pogo again…We have met the enemy and it is US (or the Cory THEY's).

Well, they do pay for all those military aircraft used to shuttle cabinet secretaries around instead of making them fly commercial.

So using Gardner logic, as long as that is continuing – and it will – DC is wasting money so we must cut taxes.